Top California Lawyers Talk PAGA Reform: Here’s What We Learned

- By Harri Insider Team | February 10, 2025

Disclaimer: Please note this blog is intended for summary purposes only. Any guidance or materials provided do not constitute legal advice and cannot be substituted for the advice of legal counsel.

It’s not every day you can get 300 people to join a 60-minute webinar in the middle of the day. That’s exactly what happened last week during the exclusive PAGA Workshop last week, we hosted with the team from the Zaller Law Group.

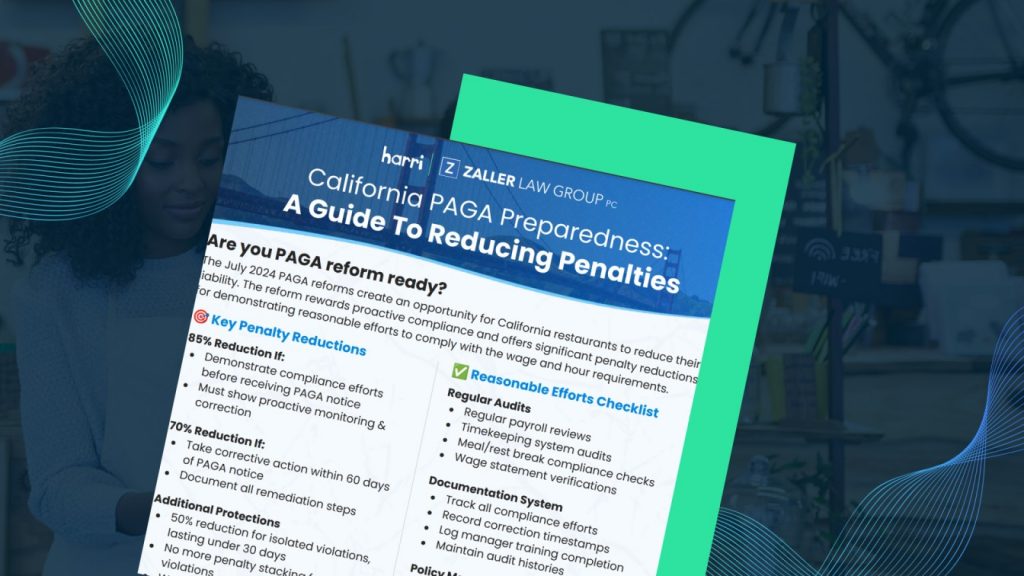

The July 2024 PAGA reforms created significant opportunities for penalty reductions, empowering restaurant operators with the ability to significantly cap their penalties up to 85% by demonstrating “reasonable steps” to comply with the Labor Code.

Based on the overwhelming response we received, it’s clear that proactive compliance is top of mind for California operators looking to mitigate risk and protect their profits amidst a background of regulatory uncertainty and historic wage pressures.

If you’re a California operator reading this and you couldn’t make it last week, you can watch the on-demand presentation to receive your 2025 PAGA Compliance Certification (please note that viewing the entire presentation is required to qualify). If you’re interested in getting access to the slides, please email marketing@harri.com.

Proactive Compliance Rewarded Under PAGA Reform

The workshop – led by compliance experts Anthony Zaller, Veenita Raj and Harri’s own Samantha Gallagher – highlighted major changes that took effect after June 19, 2024, including two key scenarios where employers can substantially cap PAGA penalties:

- 85% Penalty Reduction: Available to employers who demonstrate compliance efforts before receiving a PAGA notice

- 70% Penalty Reduction: Available when corrective action is taken within 60 days of receiving a PAGA notice

- Limits to $50 per pay period for isolated violations lasting fewer than 30 consecutive days or 4 pay periods

These penalty reductions are aimed at incentivizing employers to comply with the Labor Code while offering relief from excessive penalties for technical violations and giving them more opportunities to mitigate liability under PAGA.

The All Important "Reasonable Steps" Framework

The panel emphasized that the new law’s effectiveness hinges on employers taking “reasonable steps” toward compliance. It’s worth including the specific language:

“All reasonable steps”

“may include, but are not limited to, any of the following:

- conducted periodic payroll audits and took action in response to the results of the audit,

- disseminated lawful written policies,

- trained supervisors on applicable Labor Code and wage order compliance, or

- took appropriate corrective action with regard to supervisors.

Whether the employer’s conduct was reasonable shall be evaluated by the totality of the circumstances and take into consideration the size and resources available to the employer, and the nature, severity and duration of the alleged violations.

The existence of a violation, despite the steps taken, is insufficient to establish that an employer failed to take all reasonable steps.”

Getting PAGA Prepared, One Step At A Time

In the workshop, our expert panel talked through the specifics of the legislation and provided several actionable strategies for employers:

Documentation is Key

- Maintain detailed audit histories

- Track all compliance efforts

- Record correction timestamps

- Log manager training completion

Meal and Rest Break Compliance

Special attention was given to meal and rest break requirements, with the panel highlighting the importance of:

- Electronic and daily attestations

- Clear break scheduling procedures

- Premium pay tracking for noncompliant or missed breaks

If you’d like more of a deep dive into the meal and rest break requirements, you can read up on our blog here.

Looking Ahead: 2025 Compliance Priorities

The panel outlined several key focus areas for employers in 2025:

- Automated Monitoring Systems

- Real-time violation alerts

- Systematic audit procedures

- Training tracking platforms

- Policy Management

- Distribution of required onboarding documents

- Regular handbook updates

- Documented policy distributions

- Tracked acknowledgments

Key Takeaways for Employers

- Start implementing compliance monitoring systems now

- Establish regular audit schedules

- Create robust documentation procedures

- Train managers on corrective actions and document corrective action incidents

- Set up violation response protocols

Want your own copy of this one-pager? Reach out to marketing@harri.com with ‘PAGA one-pager’ in the subject line to get yours.

Getting Your PAGA Compliance Certificate

Workshop attendees will receive their 2025 PAGA Compliance Certificate, documenting their commitment to understanding and implementing these crucial compliance measures. This certification serves as documentation of “reasonable steps” taken to comply with California wage and hour laws.

Remember: The PAGA reforms only apply to cases filed after June 19, 2024. Earlier cases follow original PAGA rules.