The 30-Minute PAGA Audit That Could Save Your California Restaurant Millions In 2026

- By Harri Insider Team | February 2, 2026

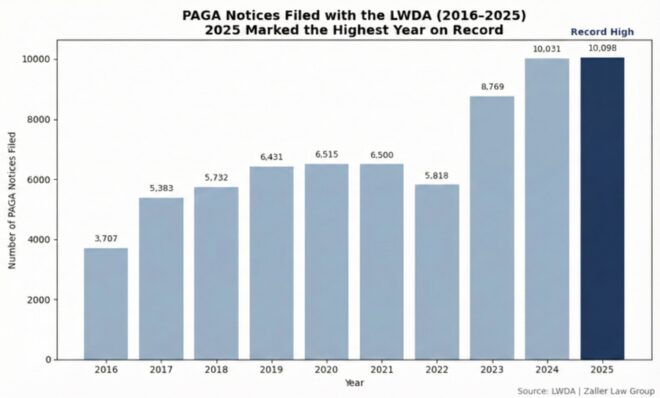

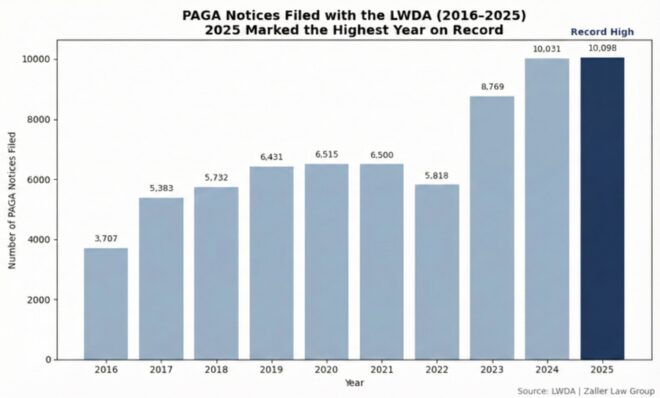

California restaurant operators just lived through the most expensive PAGA year on record. Over 10,100 cases were filed in 2025 — a staggering increase that shows no signs of slowing down despite 2024’s much-hyped reforms.

But here’s what most operators don’t realize: The 2024 PAGA reform created a massive opportunity to slash penalties by up to 85% — if you know how to use it.

The Math That Should Terrify Every California Operator

Consider this real example from our recent masterclass with Zaller Law Group and Harri:

- Old PAGA penalties: 100 employees over 2 years = $2.3 million exposure

- Reformed PAGA with proper documentation: Same scenario = under $200,000

The difference? Demonstrating “reasonable compliance efforts.” Without proper documentation, you’re paying full freight. With it, you cap penalties at 15-30% of the original amount.

Two February Deadlines You Cannot Miss

February 1st: Know Your Rights” Notice — Every California employee must receive this notice by February 1st. You cannot just post it — it must be delivered directly to each employee via email, text, or hand delivery. Keep records proving delivery for three years.

March 30th: Emergency Contact Updates — You must give employees the opportunity to update emergency contact information and ask if contacts should be notified of workplace detention or arrest.

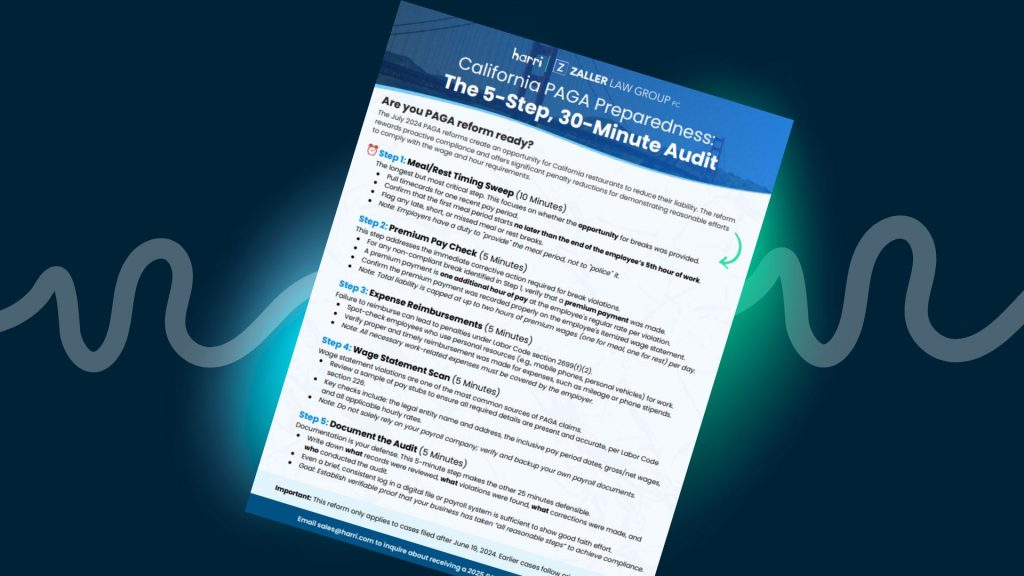

The 5-Step Audit That’s Saving Operators Millions

Top employment attorneys recommend this 30-minute weekly audit to build your reasonable compliance defense. Email marketing@harri.com if you’d like one of our compliance experts to guide you through the audit.

1. Meal & Rest Break Compliance Check

- Biggest PAGA target: Missed meal breaks still account for most violations

- Action: Use electronic timekeeping with automatic attestations

- Critical: Pay premium pay immediately when violations occur — document everything

2. Wage Statement Accuracy Review

- Audit pay stubs for all required elements (employee info, pay periods, rates, deductions)

- Don’t trust your payroll company — ultimate responsibility is yours

- Include premium payments on pay stubs for clear tracking

3. Final Pay Compliance

- Terminated employees: Final check due at time/place of termination

- Resigned employees: 72-hour rule applies unless proper notice given

- Include all wages, accrued vacation, bonuses, commissions

4. Policy & Training Documentation

- Update wage/hour policies at least yearly

- Train supervisors on compliance basics — document who attended

- Create clear off-the-clock work prohibitions

5. Corrective Action Records

- Key insight: Don’t hide violations — lean into them

- Document when issues are found and how they’re corrected

- Discipline repeat policy violators to show enforcement

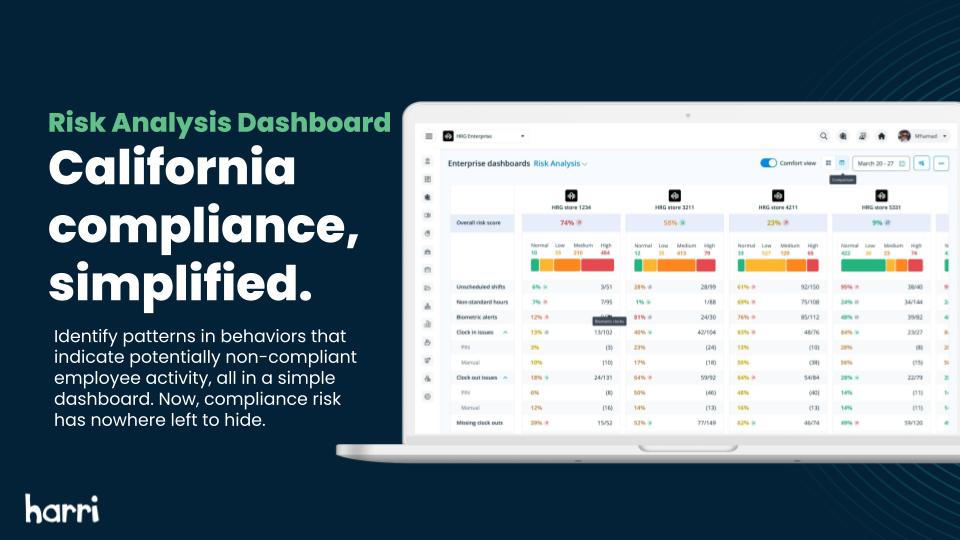

Technology Is Your New Best Defense

In 2026, one thing is for sure, manual processes are litigation landmines: “We live in the digital age. There’s no reason to track anything on pen and paper,” said Samantha Gallagher.

Smart operators are implementing:

- Automated break tracking and attestations

- Real-time compliance dashboards

- Digital documentation systems

- Automatic premium pay calculations

The Reality Check: Why Cases Keep Rising

Despite reform benefits, PAGA filings increased 15% in 2025. Why? Plaintiff attorneys are filing more cases to compensate for reduced per-case payouts. Translation: Your risk of being targeted is higher than ever.

Your Action Plan for 2026

- Immediately: Implement the February 1st notice requirement

- This week: Start weekly 30-minute compliance audits

- This month: Review and update all wage/hour policies

- Ongoing: Document every compliance effort you make

Remember: The reformed PAGA isn’t about whether violations occurred — it’s about what you did to prevent them. Start building that documentation trail now, because in California’s current enforcement environment, it’s not if you’ll face a PAGA claim, it’s when.

What To Do Next

1) Learn from your peers. Read the Fast Casual article about our work with Dave’s Hot Chicken franchise operator Cody Wong.

2) Play around with our Risk Analysis Dashboard, and see how we’re helping operators and managers identify patterns in behavior that indicate non-compliant employee activity.

3) Email marketing@harri.com to schedule time with one of our compliance experts to guide you through the 5-step 30 minute PAGA audit.