Autumn Budget 2021: Everything Hospitality Operators Need To Know

- By Harri Insider Team | November 11, 2021

During the much-anticipated Autumn Budget speech in October, Chancellor Rishi Sunak revealed some essential changes to business rates and alcohol duties – but it isn’t all we’d hoped for. In his speech, Sunak outlined desperately needed plans for post-pandemic economic recovery, but admitted that the crisis isn’t over yet.

If you missed it, don’t worry! We’ve outlined the key announcements for hospitality operators below.

Inflation Likely to Increase

Businesses and individuals face difficult times ahead following the report of rising inflation. After a dip to 3.1% in September, the Office for Budget Responsibility (OBR) forecast the Consumer Price Index (CPI) to average 4% over the next year. This could cause serious financial challenges and uncertainty about the future.

Rise in Fuel Duty Cancelled

To address the ongoing driver shortages, the planned rise in fuel duty will be cancelled, while the funding to improve lorry parking facilities is expected to rise. Sunak also announced that the government will freeze excise duty for heavy goods vehicles (HGV). Meanwhile, the HGV vehicle levy has been suspended further, until 2023.

New Business Rates Discount

A much-needed 50% business rates discount for the hospitality, retail and leisure sectors was put forward, up to a maximum of £110,000 for one year. While this may sound like positive news for smaller companies, it will have limited benefits for larger organisations that are describing this as a ‘superficial response’.

Wages are Going Up

The government has accepted recent recommendations from business groups, trade unions and economists to increase the National Living Wage from £8.91 to £9.50 (6.6%) per hour. This will apply to workers aged 23 and over, but, while it may be great news for employees, it could cause major financial difficulties for employers – particularly those with a large workforce.

Alcohol Duty System to Change

Currently, the alcohol duty system (introduced in 1643 to help pay for the Civil War) is outdated and complex. That’s why the government has cut the main duty rates on alcohol from 15 to just 6, in what Sunak calls the most radical simplification of alcohol duties for over 140 years. This new, more logical system will be based on a ‘common sense’ principle that the stronger the drink, the higher the rate.

No Mention of VAT

Following UKHospitality’s recent #VATsEnough campaign, which called on the Chancellor to permanently freeze VAT at 12.5%, we were all eagerly awaiting further details from Sunak. Frustratingly, this wasn’t covered during the speech, and therefore we can only assume that it will return to its pre-pandemic level of 20% in April 2022.

Take Advantage of Harri

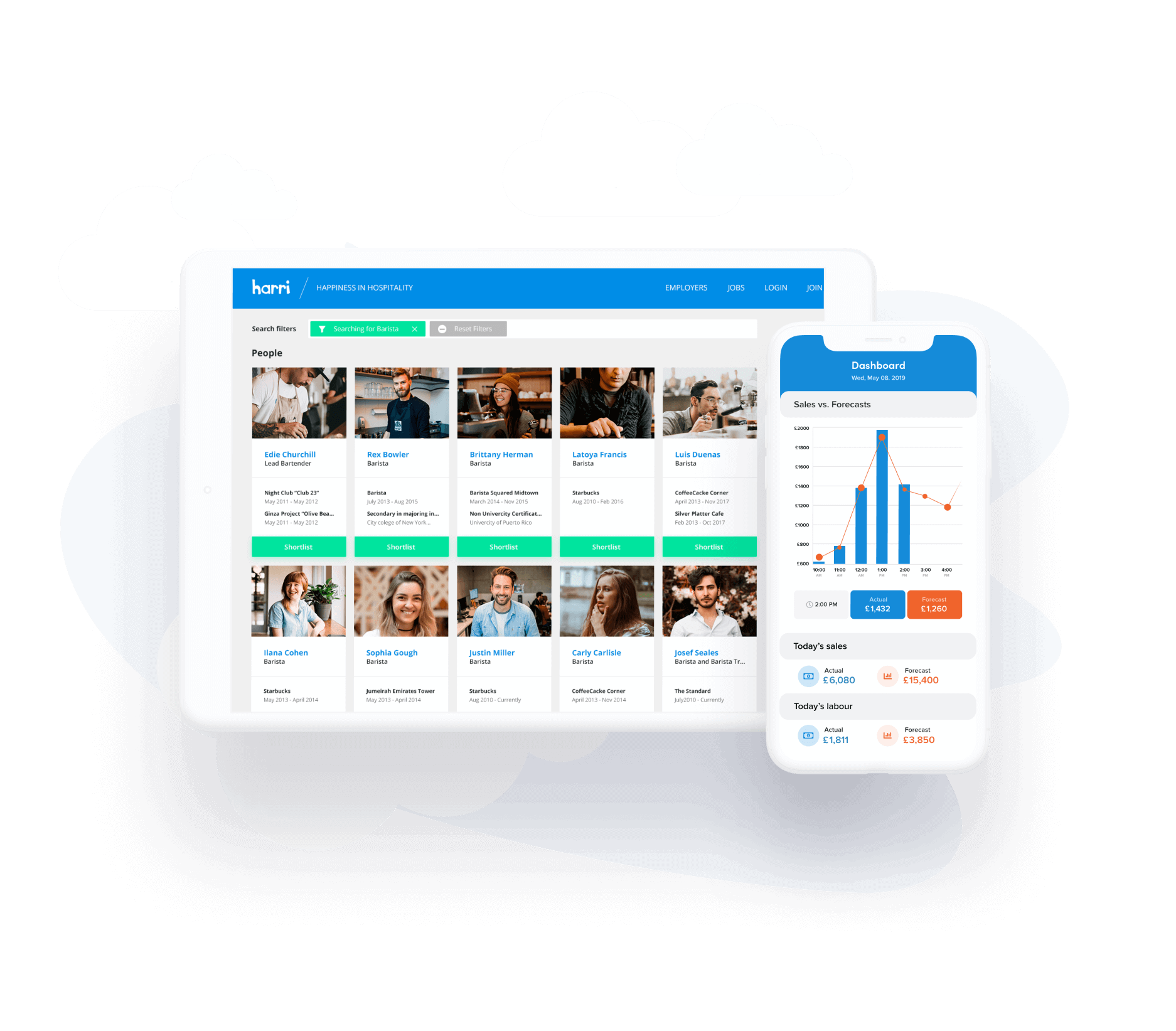

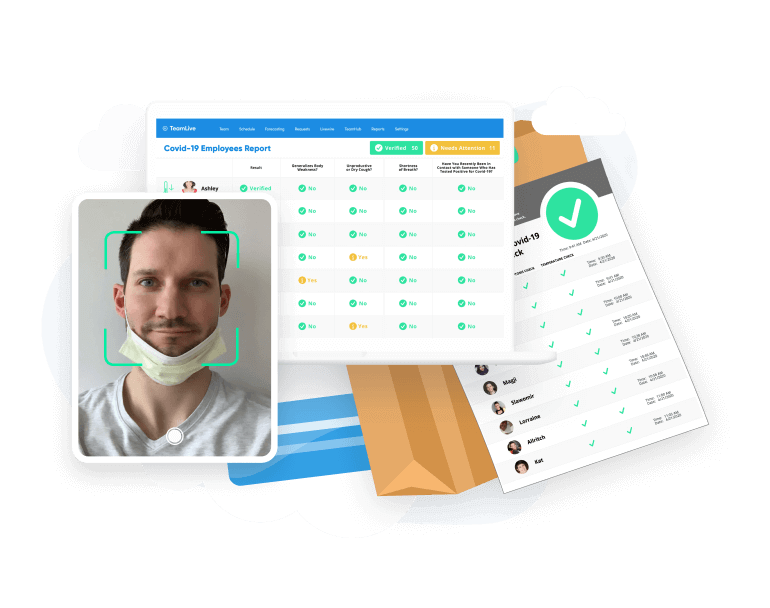

Managing your operational costs has never been more important, but doing so can be challenging – especially during these uncertain times. That’s where our technology comes in.

Our smart scheduling tool makes sure you only spend the necessary amount for labour, without sacrificing on customer service. It does this by automatically generating position-based, performance-based and skill-based schedules to ensure operational success. There’s even a fully integrated payroll system capable of delivering pay swiftly, accurately and confidently.

Looking for skilled workers to assist you during the busy festive season? Our digitised system makes sourcing and attracting top talent and onboarding them quick, easy and cost effective! Want to learn more about Harri? Request a free demo today!