Everything You Need To Know About Fair Workweek Compliance Under Mayor Mandami

- By Harri Insider Team | February 2, 2026

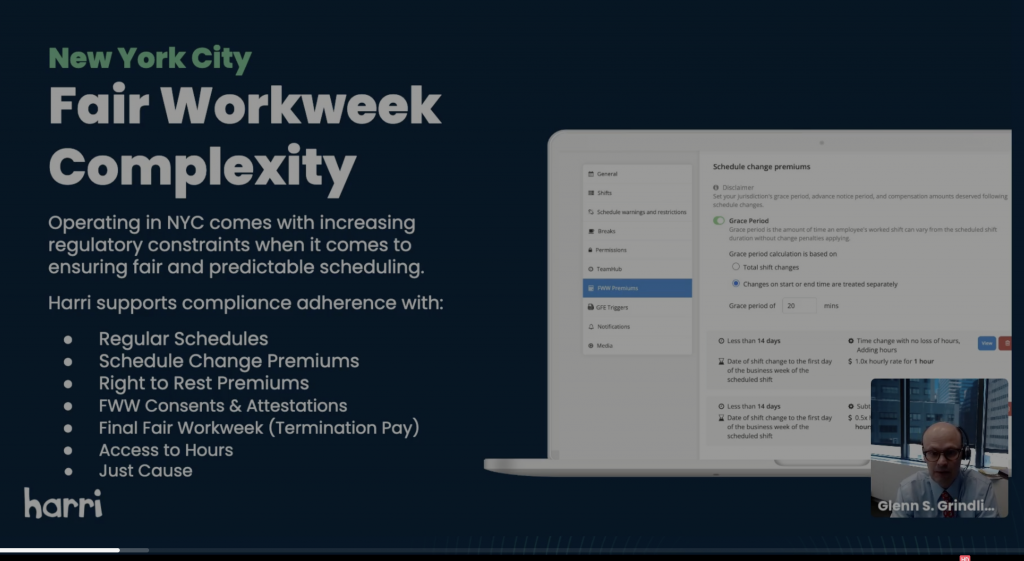

The 2026 New York City Fair Workweek Compliance webinar, hosted by Samantha Gallagher, Harri’s Director of Product Compliance, and Glenn Grindlinger, Partner at Fox Rothschild, provided critical insights for restaurant owners, franchise operators, HR leaders, and legal teams navigating the evolving Fair Workweek landscape. With a new mayoral administration signaling more aggressive enforcement, 2026 promises to be a pivotal year for compliance.

Summary: What You Need to Know

Coming off the heels of Starbucks’ $39M settlement in December, operators can no longer afford to be complacement under the new administration. Fair Workweek compliance is no longer just about meeting minimum requirements. It’s about proactive operational rigor, defensible documentation, and disciplined scheduling practices.

The webinar highlighted that enforcement is moving away from complaint-driven audits toward proactive investigations, random audits, and potentially “secret shopper” tactics to identify violations.

Key insights from the session:

- Just Cause Requirement: Since 2022, employers can no longer terminate employees at will. Terminations must follow progressive discipline, bona fide economic reasons, or egregious misconduct. Accurate documentation of every disciplinary step is now critical.

- Documentation is King: Date-stamped schedules, published shift offers, and documented employee consent are essential. Paper files are insufficient; digital workforce management tools are strongly recommended.

- Premiums and Schedule Changes: Offering shifts to existing employees first and compensating for schedule changes remains a major compliance focus. When in doubt, paying the premium is safer than risking penalties.

What’s Already Changed in 2026 and Its Impact

- Increased scrutiny under the new administration: Even minor compliance gaps, like incomplete schedules or missing documentation—can trigger fines.

- Proactive investigations: Employers can expect audits even without employee complaints. Random requests for historical scheduling and labor data (up to three years) are likely.

- “Just Cause” enforcement intensifies: Employers must ensure every termination and disciplinary action is backed by documentation to avoid disputes.

Where NYC Enforcement is Expected to Tighten

- Documentation: Employers must provide verifiable proof of schedules, shift offers, and employee consent, with accurate date and time stamps.

- Premium compliance: Missed rest periods, schedule deviations, or last-minute shift changes are increasingly targeted.

- Manager accountability: Managers are now expected to understand and execute Fair Workweek workflows correctly; systemic noncompliance can carry penalties.

- Data retention and audits: Expect less flexibility in providing partial records; authorities may demand full, detailed historical data.

Potential Impacts on Operations

- Scheduling flexibility: Operators may have to limit deviations from regular schedules to stay within the law, potentially affecting labor optimization and operational responsiveness.

- Premium payouts: More rigorous tracking and timely payment of schedule-change or right-to-rest premiums are essential.

- Recordkeeping: Digital systems are recommended to ensure defensible records and reduce administrative risk.

- Manager practices: Managers must be trained on compliance, accountable for operational execution, and supported with proper tools.

What Operators Should Audit Now

To reduce risk and avoid costly violations, hospitality and franchise operators should:

- Review all current schedules to ensure consistency with regular schedules and proper advanced notice.

- Audit past premiums for schedule changes, shift extensions, and rest period compliance.

- Verify documentation practices: ensure employee consent is recorded, timestamped, and stored securely.

- Assess manager accountability and training to confirm all staff understand workflows and compliance requirements.

- Evaluate digital workforce management tools to streamline scheduling, documentation, and reporting.

Key Takeaways

- Proactive compliance is no longer optional: NYC authorities expect rigor, accuracy, and defensible records.

- Documentation and digital tools are essential: Paper records create risk; digital systems provide traceability and efficiency.

- Manager accountability matters: Frontline execution determines compliance; training and oversight are critical.

- When in doubt, pay the premium: Avoid small violations escalating into costly audits or penalties.

In short, 2026 demands that operators treat Fair Workweek compliance as a core operational priority, not just a legal formality. By auditing schedules, reviewing premiums, strengthening documentation, and empowering managers with the right tools, hospitality and franchise businesses can stay compliant, reduce risk, and focus on running their restaurants efficiently.

Disclaimer: This article is provided for informational purposes only and does not constitute legal advice.