Hospitality And Tourism Operators Demand 12.5% VAT Freeze

- By Harri Insider Team | November 3, 2021

Hospitality and tourism operators across the country are calling for the government to permanently lower the VAT rate to protect thousands of jobs. This comes after the tax rate for restaurants, pubs, bars, hotels and other sector businesses rose from the temporary 5% reduced rate to 12.5%.

Let’s take a closer look at what’s happening and how it’s affecting hospitality and tourism venues in the UK.

Changes to VAT for Hospitality and Tourism

On 15th July 2020, the UK government announced a temporary reduction in VAT from 20% to 5% to help the struggling sector recover from the pandemic. This was set to end on 31st March 2021, but was later extended until 30th September 2021.

The temporary 5% VAT rate has now come to end, and has been replaced with a new reduced rate of 12.5% until 31st March 2022. By 1st April 2022, this will rise to the pre-pandemic level of 20%, but operators claim the increase is poorly timed.

UK Trade Bodies Unite

In October, UKHospitality launched the campaign ‘#VATsEnough’, calling on Chancellor Rishi Sunak to permanently freeze the 12.5% VAT rate for hospitality and tourism businesses. The leading hospitality trade association has urged venues, employees, suppliers and customers to lobby their MPs on the need to ‘lock in’ the 12.5% rate.

Kate Nicholls, Chief Executive of UKHospitality, said:

“We’re launching the #VATsEnough campaign because a failure to act risks the future of hotels, cafés, pubs, restaurants and myriad other venues and attractions across the country. Our businesses bring light, life and heart to communities across the country but are battling huge challenges in terms of labour shortages and the food supply chain after 18 months of desperate struggle due to the pandemic.”

And they’re not alone. The British Beer and Pub Association, the Tourism Alliance, the British Institute of Innkeeping, and the Association of Leading Visitor Attractions have all asked the government to make the current 12.5% VAT rate permanent.

What the Reduced Rate Means for Operators

A survey of the trade associations’ members covering 815 companies found that the reduced rate of VAT has been vital to operations, with 77% stating it’s important or crucial to viability. As one would expect, returning to a 20% rate in 2022 would have serious consequences – one of the most obvious being loss of staff.

In response to the survey, 6 in 10 businesses said the return would most likely lead to ‘cutbacks’ and ‘job losses’, with 1 in 10 claiming it could cause their businesses to close for good. This is especially true if they’re forced to pass on higher costs to customers – doing so will negatively affect the frequency of visits to the sector and in turn impact revenue.

So, what would happen if the government decided to freeze VAT at 12.5%? According to the study, it would boost turnover by an average of 8.8%, and increase investment by approximately 12%. Just imagine what this could mean for your business… but unfortunately, imagining is all we can do at this point.

Take Control with Harri

Unless the government agrees to freeze the current VAT rate, hospitality businesses will have to prepare for a rise to 20% in April 2022. This emphasises the need to manage your operational costs, especially during these difficult times. Fortunately, our technology can help.

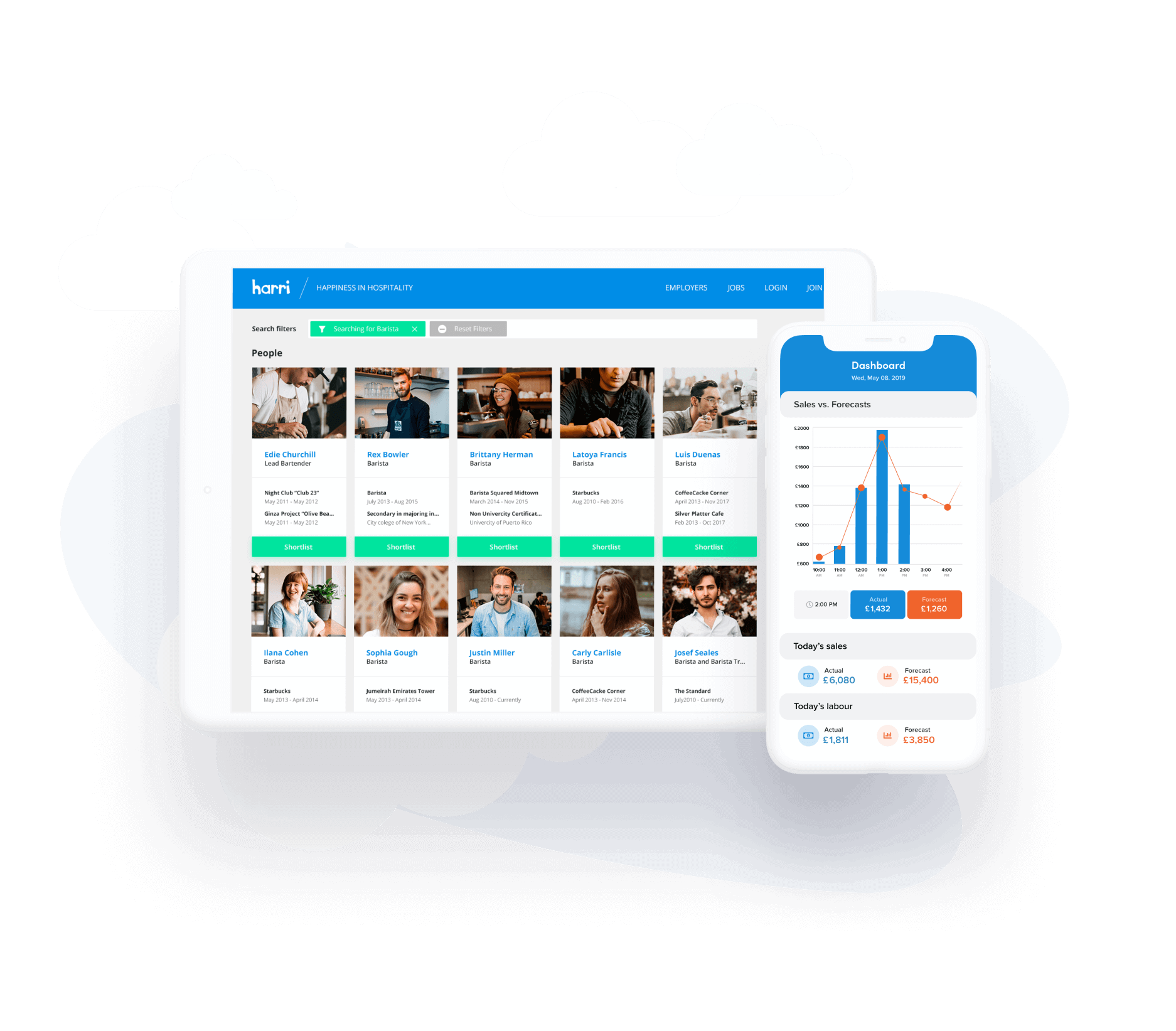

Our smart scheduling tool ensures you only spend the necessary amount for labour without sacrificing on customer service. It automatically generates position-based, performance-based and skills-based schedules, and builds optimal shift structures based on employee availability, local labour laws, and other essential analytics.

If you’re looking for an end-to-end solution that can consolidate your costs, Harri also offers a fully integrated payroll system that can deliver pay accurately, quickly, and confidently. And for all your hiring needs, our talent acquisition suite enables you to easily reach, recruit, and engage active and passive candidates. Fragmented technology not only kills productivity and gets in the way of true operational efficiency, but it also can result in higher running costs.

Does this sound like something that could benefit your business? Request a free demo today!

If you found this post interesting, we recommend subscribing to Harri Insider. Once signed up, you’ll have unlimited free access to the latest (and greatest!) labour-related news and trends.