NYC Hospitality Compliance Guide: A List of Incoming Labor and Wage Laws

- By Harri Insider Team | January 25, 2021

With President Biden in office, pro-employee legislation is expected to vastly impact the nation’s workforce. Hospitality operators are gearing up for changes to labor operations, wages, and much more.

As a Democratic city, NYC is much further ahead in labor and wage regulations than other jurisdictions in the US, so will the Biden administration really bring significant changes to our local hospitality industry?

The answer is yes. Below, we’ll cover incoming and expected legislation affecting NYC hospitality, as well as how HCM tech can be used to effectively plan for and offset change-related costs.

Incoming pro-employee legislation impacting NYC hospitality

Removing tip credit and the impact on hospitality

Tip credit is when an employee is paid below minimum wage, but their earned tips combined with their hourly pay equals at least minimum wage. Most restaurants operator off tip credit, so a sudden removal will make significant ripples in NYC hospitality operations.

These are the current NYC hourly rates with and without tip credit

Service employees

- $12.50/hr cash wage

- $2.50/hr tip credit

Foodservice employees

- $10/hr cash wage

- $5/hr tip credit

Many believe that the removal of tip credit in NYC will have negative impacts on both employers and employees. Tip credit allows employees to earn at least minimum wage without inducing additional labor costs onto the employer.

According to Credit Suisse, tip credit allows Olive Garden employees to earn approximately $16-17/hr, while Capital Grille employees earn around $40/hr. Tip credit enables high earnings potential beyond that of minimum wage.

But removing tip credit can be beneficial for employees who don’t have the potential to earn such high tips and are stuck at a slightly lower minimum wage.

How does this all impact employers? Labor costs will skyrocket, potentially forcing restaurant operators to reduce hours or eliminate jobs — similar to how NYC restaurants first responded to the $15/hr minimum wage introduced in 2019. For this reason, our tip credit survey found that 81.8% of restaurant operators were in favor of tip credit in order to maintain a great customer experience.

These financial impacts are amplified during the pandemic as restaurants juggle widely unpredictable service demands (even for hospitality), ever-changing outdoor dining guidelines, and massive shifts in day-to-day operations.

The 80/20 rule is here to stay

Related to tip credit, the 80/20 rule states that tipped workers cannot spend more than 20% or two hours of their shift on non-tipped activities if they are being paid sub-minimum wage. Non-tipped activities can include taking inventory, cleaning drinkware, and other essential service or operations tasks.

If the 80/20 rule is violated, employers need to bump up the affected employee’s salary to at least minimum wage for days they spend 20% of their time on non-tipped activities. Tip credit may be removed in some circumstances.

Like other hospitality labor laws, the 80/20 rule presents itself as a double-edged sword.

On one hand, allocating tipped employees more time to focus on tasks that allow them to earn high tips, the bulk of their wages, is a great concept. It opens the doors to higher earnings potential.

However, non-tipped activities often are essential for employees to provide great service, thus earning substantial tips. This is especially true during COVID-19, where much more time must be allocated towards sanitary measures — oftentimes to protect the employee themselves. The 80/20 rule can work in extreme cases of servers performing non-tipped activities, but more often than not end up hindering tipped employee earned wages.

NYC restaurant operators can expect higher labor costs in situations where tip credit is removed. Daily operations are more likely to be interrupted if a tipped employee is approaching their 20% mark, and restaurants may find themselves hiring part-time staff solely to handle non-tipped activities.

Removal of At-will employment

NYC was one of the first cities to remove “At-will Employment,” instead replacing it with “Just Cause” and “Progressive Discipline” measures.

Previously, hospitality businesses had the ability to dismiss an employee on the spot without providing reason for the dismissal. The one exception here was that employers were not permitted to discriminate against an employee’s religion, race, gender, sexual orientation, etc.

Removal of At-will employment means an employer can’t do the following without “Just Cause

- Reduce an employee’s hours by 15%

- Fire or suspend an employee

What is considered Just Cause? It’s made up of a few different pieces.

First is education. The employee must receive proper job training and must be made fully aware of job expectations as well as the employer’s rules and policies.

If an employee is underperforming or violates a rule? The employer must conduct an investigation of the employee’s job performance and anything else related to the potential rule violation.

From there, Progressive Discipline must be acted upon before the employee can be fired or receive significant schedule cuts. Progressive Discipline must be applied consistently and within reason.

After all is said and done, the employer must provide written reasons for the employee’s dismissal. This written statement is the only document, alongside proof of Progressive Discipline, an employer can use as defense if the employee challenges their dismissal.

It’s important to note that Just Cause only applies to employees that pass a 30-day probationary period from their first day on the job.

So what does all of this mean? Employers will need to get serious about documenting corrective actions and properly training their employees, or else they may run into legal troubles when trying to re-staff operations.

NYC Fair Workweek

Fair Workweek labor laws in NYC went into effect in November 2017 with the intent of creating fair and predictable working conditions for service and hospitality employees. As Biden’s pro-employee administration begins to mobilize workplace laws, we may see some modifications to existing Fair Workweek regulations that could impact daily restaurant operations and labor costs.

We break down the full list of NYC Fair Workweek requirements, but here’s a quick overview of what you need to know and how it affects hospitality.

- Employers must produce employee schedules at least 14 days in advance

- Employee schedules must have 11 hours of rest in-between shifts

- Last-minute schedule changes require employee consent

- Employees must receive a written Good Faith Estimate of hours worked

- New shift opportunities must be offered to existing employees before hiring new staff

- Non-compliance with any Fair Workweek law results in premium payments towards affected employees for each violation

Although Fair Workweek attempts to find a balance between fair employee work environments and employer service needs, the laws open more gray areas than anything else.

Most hospitality professionals are in favor of Fair Workweek — nobody wants to uphold poor working conditions, and the improved employee morale results in better service and higher retention. However, adapting to these laws can prove extremely difficult, especially when considering how unpredictable hospitality really is.

The PRO Act and unionization

President Biden is known as a pro-union supporter, which means the Protecting the Right to Organize (PRO) Act is not off the table for NYC hospitality businesses.

The PRO Act, a legislation that failed to pass in the past, gives employees more power to form unions and strike without retaliation.

Pro-labor changes are moving fast and Biden is under more pressure than usual to pass the PRO Act. This emphasizes hospitality’s need to focus on the employee experience by exploring tech-based retention strategies.

NYC hospitality operators will want to focus on creating and maintaining favorable workplaces and take team concerns into serious consideration to decrease the likelihood of employee strikes. While NYC’s lean towards pro-employee legislation decreases the chance of striking, the formation of a nationwide hospitality worker’s union could pose major labor and wage changes in the future.

Pro-immigration reforms

President Biden is pro-immigration and almost immediately into his presidency announced the U.S. Citizenship Act of 2021, a policy that transforms successful immigration into an 8-year process. Support for the Dreamers program, Deferred Action for Childhood Arrivals (DACA), Temporary Protected Status, and a less stringent Green Card process makes all of this possible.

His pro-immigrant is generally regarding great news for hospitality operators as they navigate an ongoing talent crisis.

According to QSR Magazine, 29% of restaurants and hotels in the US are owned by immigrants. The hospitality workforce embraces immigrants in service-based positions as well, providing career opportunities to those seeking citizenship.

Preparing for pro-employee legislation in NYC

Compliance strategies will be key as NYC hospitality navigates incoming legal changes proposed by the Biden administration. Leaning on an all-in-one HCM platform enables unit-level flexibility to adapt to any legal challenges while also proactively preparing for future operational challenges.

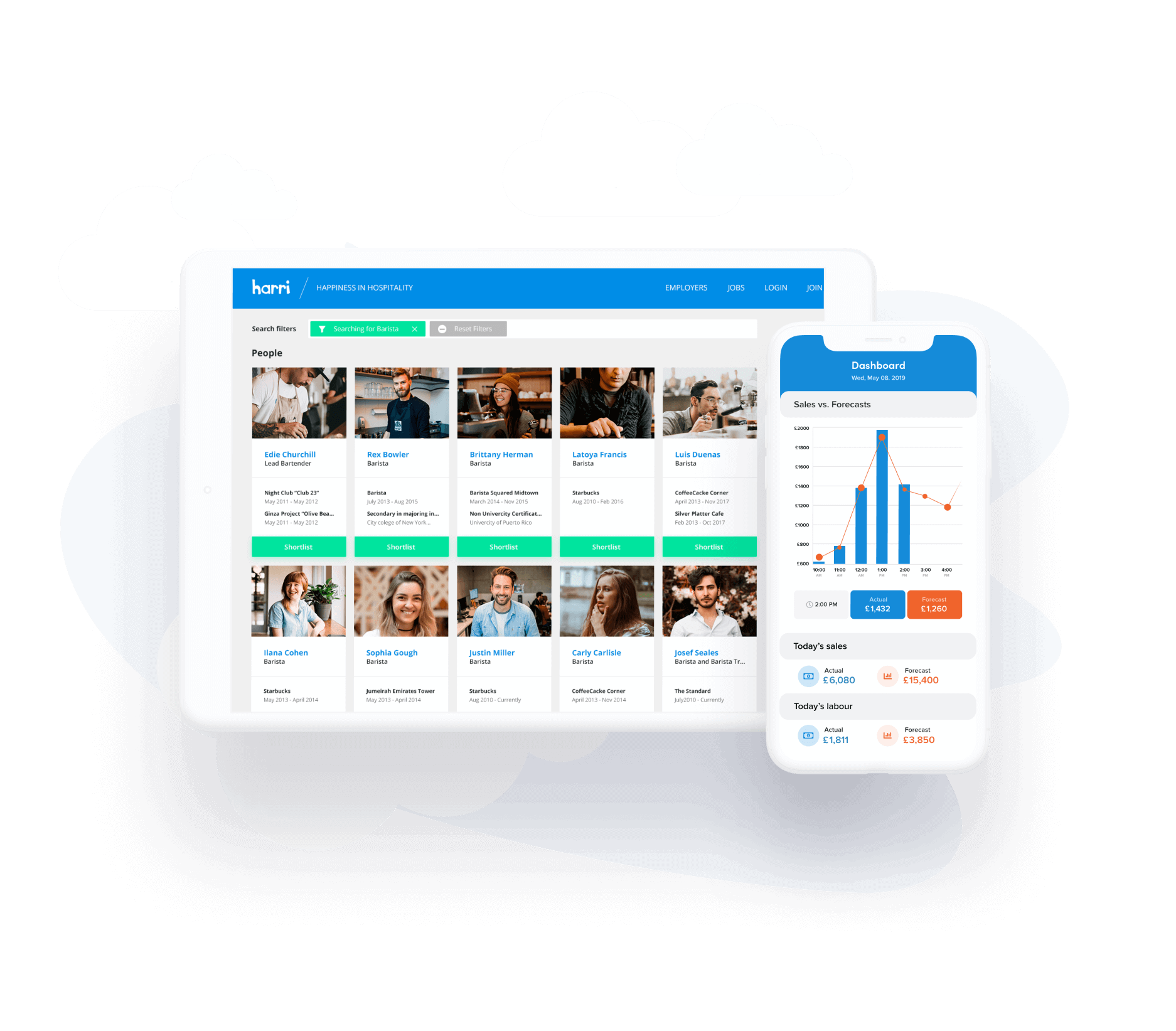

Intelligent scheduling tools for effortless labor compliance

NYC hospitality businesses are no stranger to scheduling laws like Fair Workweek, and many have adapted day-to-day operations to stay compliant.

However, most operators are not aware that solutions exist to streamline their ongoing scheduling processes to ensure operational efficiency at low cost — and without the headache of navigating compliance complexities, overtime, and break laws.

Intelligent scheduling tools like Harri automatically consider federal labor laws as well as NYC-specific legislation, then combine those requirements with historic business data to ensure optimal, fully compliant schedules.

Reduced labor costs aren’t the only benefit. Hospitality businesses that employ intelligent scheduling are better equipped to empower managers to run efficient workplaces. Think about how much restaurant managers have on their plates in terms of daily operations, creating compliant yet efficient schedules, and gauging when premium payments for last-minute labor is necessary. And that’s not including their service-related duties.

Quality service starts with the schedule. The more automation you can introduce into that process, the more time your team has to dedicate towards creating a great customer experience.

Real-time data analytics and forecasting

Throughout this article, we highlighted how incoming pro-employee legislation will impact NYC hospitality businesses, and almost every proposed change promises to significantly impact labor costs.

The problem is that labor costs are tied to so much more than employee wages. Operators must consider hours worked, premium payments, tip credit (or lack thereof), overtime, sales demand, employee performance, and more. Standard balance sheets won’t cut it in today’s world of compliance chaos.

Harri’s customizable data dashboards enable your team to drill down on specific data points or get a bird’s-eye view of performance and costs across your entire business in real-time.

Because the Harri platform interconnects all HCM data, you have access to all the tools you need to identify process gaps or success trends.

Track sales patterns to understand labor costs vs labor demands. Understand how employee performance correlates with overtime. Report on wage data over time to gauge the long-term impact of Fair Workweek-compliant schedules.

These are all small parts to the whole of data analytics, and they’re just scratching the surface.

Digital records of corrective actions, hours worked, and more

NYC businesses suspected of violating labor or wage laws, need to provide proof of innocence or guilt. If you don’t have proof, you’ll get hit with additional legal fees on top of an investigation. That means hospitality operators need to keep a constant digital record of every workplace action.

This holds true for corrective actions which typically stand as informal processes. If an employer is trying to dismiss an employee under the Just Cause regulation, they need to document every training measure and progressive disciplinary action taken — including written warnings.

HCM tools like Harri keep a digital record for everything including:

- Employee schedules and schedule changes

- Employee-to-employee shift swaps

- Clock-in times and absences

- Wage and demographic data

- Good faith hour estimates

- Break requests or waivers

- Premium payments paid, to who, and how much

So the next time you need to call an employee in last-minute to handle an unexpected rush of customers, your HCM platform will automatically document the employee hour changes, wages associated with the last-minute call-in, and premiums paid to that employee.

Alone it might not sound like much, but when you manage 50 employees and need to pull a 3-year old record to prove innocent in a labor compliance suit, your HCM platform has your back.

Non-compliance alerts to avoid legal fees

As noted above, keeping up with NYC’s many intertwining legal and wage laws can prove to be tricky indeed,

Were employees’ schedules distributed at least 14 days in advance? Two employees want to swap shifts, but does that make employee X eligible for overtime payments? Is that employee now eligible for a break?

The right solution will alert you of potential compliance breaches before they happen so your team can plan the most efficient course of action. Harri provides real-time alerts related to schedule changes, employee hours, wage changes, and more to ensure 360 degrees compliance awareness across your entire organization.