Serving Up Compliance: A Masterclass for California Restaurants

- By Harri Insider Team | December 11, 2024

This post is not intended to be legal advice. It is to be used for summary & informational purposes only.

Running a restaurant in California is no walk in the park. It’s more like running a marathon…on a tightrope…while juggling. And for multi-unit operators managing dozens of locations, that tightrope stretches even further, spanning a compliance minefield that’s constantly shifting.

That’s exactly what the California Compliance Masterclass tackled. The panel brought together experts with firsthand experience navigating California’s complex labor laws, including Peter Montes, a franchisee who oversees 29 McDonald’s restaurants in California.

The panel, moderated by Samantha Gallagher, Director of Product Compliance at Harri, also included Steven Gallagher, a seasoned Fox Rothschild attorney specializing in high-stakes wage-and-hour cases.

The webinar focused on four critical areas: minor employment, overtime laws, Fair Workweek compliance, and meal and rest breaks. California labor laws don’t come with guarantees—but with the right compliance systems, you can be as reliable as an ice cream machine that’s always working.

For a breakdown of California labor laws, check out more here. But if insights, strategies, and firsthand experience are what you’re after, keep reading.

Compliance in Crisis: 91% of Workers Report Violations

A new report released this summer by researchers from Harvard Kennedy School and UC San Francisco surveyed nearly 1,000 California restaurant workers and found that 91% reported experiencing at least one labor law violation. Think about that. In a state with some of the strictest labor laws in the country, non-compliance is the norm, not the exception.

Workers reported unpaid overtime, skipped meal and rest breaks, and even received less than the minimum wage. The scope of these issues shows just how easily compliance can slip through the cracks, especially in hospitality, where things can move quickly.

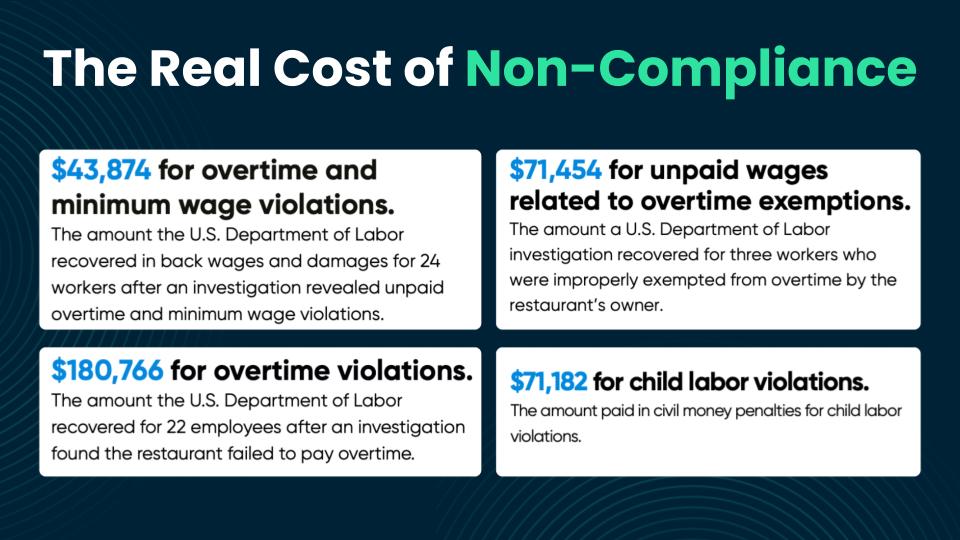

And when compliance fails, the penalties add up fast. California’s “per employee, per pay period” penalty structure is unforgiving. Fines are calculated for every affected worker with every paycheck, turning a small oversight into a massive financial burden. A single missed rest break can quickly snowball into thousands, or even millions, of dollars in penalties.

“The biggest contributors are overtime, meal premiums, rest premiums, failure to provide meal periods and rest breaks,” shared Steven Gallagher. “These numbers, once it usually comes to my desk, are usually in the very high six figures and can go up to eight- and nine-figure demands. They add up really quickly and can be very costly.”

The Golden Standard of Meal and Rest Break Compliance

Meal and rest break violations can spiral quickly in California. Here’s how operators can stay ahead:

- Policy and Documentation. Write a clear break policy and make sure employees and managers know it inside out. Documentation is your first line of defense.

- Time Tracking. Use technology to capture the details—did a break happen, was it waived, and was a premium paid if required?

- Employee Training. Managers and staff need more than a checklist; they need the knowledge to make compliance second nature.

- Stagger Break Schedules. Smooth scheduling avoids coverage gaps and keeps compliance on track.

- Regular Monitoring. Audits catch issues early, saving you from penalties down the line.

- Intelligent Automation. Automate the heavy lifting with tools designed to handle compliance complexities.

Audience Q: How are you managing California break requirements?

“We trained our GMs to understand that when somebody misses a break or a 30-minute lunch, it’s actually costing us money versus saving us money during the lunch rush,” shared Peter Montes. “For two years straight, we talked about it every single month. The constant communication and training saved us—we went from $30,000 a month in violations down to less than $1,000.”

“It’s really about going back to the basics and figuring out the sweet spot for your schedules. We shifted a lot of schedules to four-and-a-half or five-hour shifts to avoid hitting that six-hour mark where violations could happen,” shared Peter.

“We started scheduling an extra person just to give out all the breaks. We took the labor hit on that versus paying premiums, penalties, or exposing ourselves to bigger losses. It turned out to be cheaper to bring in one extra person, and it’s really helped us stay compliant over the past couple of years.”

A New Chapter in PAGA Compliance

Systematic failures to provide meal and rest breaks are one of many triggers for massive claims under California’s Private Attorneys General Act (PAGA). But PAGA isn’t limited to breaks; it covers a wide range of labor law violations, from unpaid wages to recordkeeping errors.

The good news? A major reform to PAGA went into effect on June 19, 2024, giving businesses a chance to significantly reduce their penalties. But there’s a catch: you have to show your work. To qualify for reduced penalties, employers must demonstrate a “good faith effort to comply” with labor laws.

The reform is like an extra value meal for compliance; less costly penalties for operators who proactively follow the rules. California’s saying, “Show us you’re trying, and we’ll go easier on you.” It’s a big shift, but the ball is in your court.

What does that look like?

- Regularly monitor and update employee handbooks to ensure they reflect current labor laws.

- Conduct periodic payroll audits to catch issues early and correct them before they escalate.

- Document compliance efforts systematically to create a clear record of good faith practices.

One important note: these reforms only apply to cases filed after June 19, 2024. Earlier cases will still follow the original, stricter rules.

Minimum Wage Steals the Spotlight

California’s minimum wage hike to $20 per hour impacts not only wages but also exempt employee classifications, which now require a salary of $83,200 to qualify. Operators must also account for adjustments to meal or lodging credits, new posting requirements, and the broad scope of the law, which extends beyond fast food to include coffee shops and other quick-service establishments.

“The cost is something real to consider,” shared Steven. “With this increased minimum wage, violations can get really expensive. Two premiums in a shift is an extra $40. If you have repeat violators day in and day out, that’s a cost you should be really aware of and focus on.”

Peter added his perspective: “It was definitely a big change for us. In Silicon Valley, we didn’t feel the effect as much as our partners in other areas with lower wages, but we all still felt the hit. It’s good for employees, but it made everything else go up. Once managers understand it’s not just $20 an hour—that it impacts violations, premium rest breaks, and overtime—it changes the culture and eases the pain.”

California Compliance Resources:

- Email marketing@harri.com for a copy of our 2025 California Compliance Checkup.

- The Restaurant Operators Guide to California Compliance

- Does Your California Compliance Make The Grade? – Take the quiz here