Webinar Recap: Harri And Aprio Support Hospitality With Financial Advisory

- By Harri Insider Team | March 17, 2021

This month, Brooklyn Clasby, Senior Enterprise Account Executive, at Harri caught up with Yousuf Hasan (Founder, Whetstone Hospitality Consulting), Adam Venokur (Northeast Regional Managing Partner, Aprio), and Tommy Lee (Partner-in-Charge, Aprio) to discuss the Employee Retention Credit, who is eligible, and how to apply.

Understanding the Employee Retention Credit (ERC)

The ERC is a tax credit available to business owners that awards them for keeping employees on payroll for an extended period of time. The Employee Retention Credit was recently extended from 2020 into 2021 to cover additional pandemic-related losses.

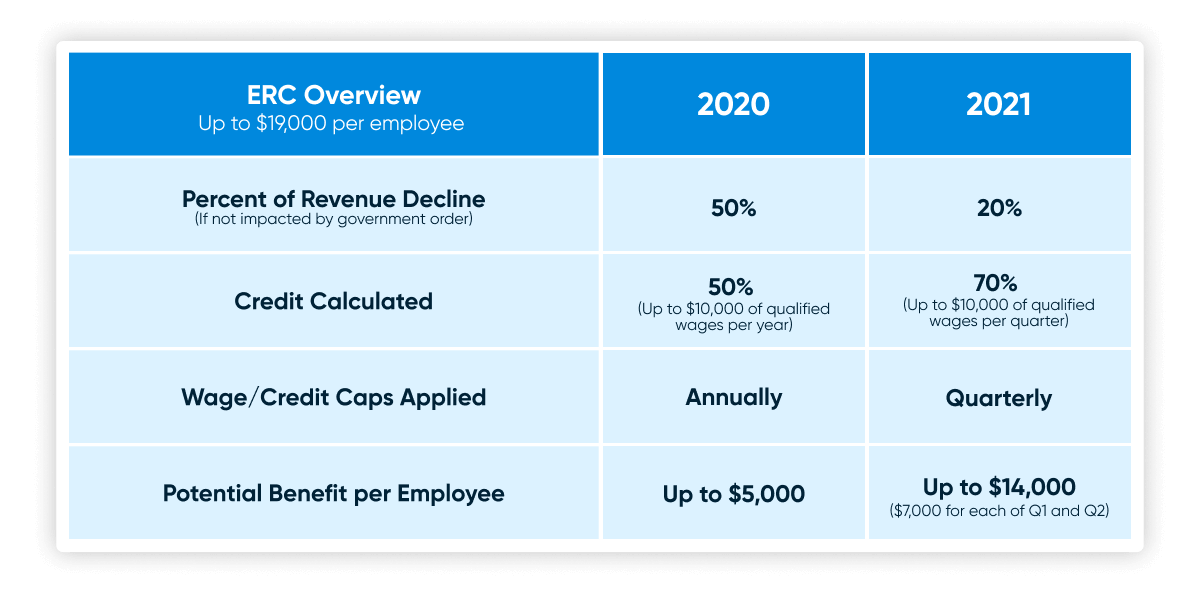

With the ERC, employers are eligible for a refundable federal payroll tax credit up to $19,000 per employee. Unlike other financial aid options, the number of employees employed by a company does not affect its eligibility to claim the credit, leaving this open to businesses of all shapes and sizes.l

The panelists discuss the importance of claiming this credit before the deadline hits, “the IRS urges employers to take advantage of the newly extended employee retention credit, designed to make it easier for businesses that, despite challenges posed by COVID-19, choose to keep their employees on the payroll.”

ERC extensions: changes for the 2021 period

In December 2020, the Consolidated Appropriations Act of 2021 (CAA) was signed into law, extending the Employee Retention Credit into 2021.

Expanded eligibility for the ERC

Businesses that have already received (or will receive) PPP loans are now eligible for an additional round of funding.

The CAA also lowered the eligibility threshold to accommodate “a significant decline in gross receipts,” which we cover below.

ERC credit extension

The ERC credit is now worth up to $19,000 per employee with an extension to June 30, 2021

Who is eligible for the Employee Retention Credit?

The ERC is available to any private-sector businesses or tax-empty organizations whose business meets one of the following criteria:

Option 1: Experienced a significant decline in gross receipts during any quarter

- 2020: Receipts declined by at least 20% of what they were for the same calendar quarter of 2019

- 2021: Receipts declined by at least 50% of what they were for the same calendar quarter of 2019

Option 2: Business operations were fully or partially suspended due to COVID-related federal or state government limitations on commerce, travel, or group meetings.

Adam highlights that restaurants and hospitality businesses are more likely to be eligible under the first option as a result of COVID-19.

Fully or partially suspended business operations as highlighted in Option 2 “gets a little bit grayer,” according to Tommy Lee, but should be straightforward to the restaurant business. “If the business can operate with some but not all formal operations, we see just about every restaurant meet this definition.”

This is referred to as a “Nominal Portion” of business. For example, if a dining room was shut down due to COVID-19 but its sales the previous year were greater than 10% of overall sales during the pandemic, the restaurant is eligible for the ERC. This applies even if that restaurant is making strong drive-thru sales.

Calculating the Employee Retention Credit total

The panelists outlined necessary steps to calculate the Employee Retention Credit aid amount for 2020 and 2021, which vary slightly from one another. These numbers depend on Qualified Wages, which includes the employee amount.

Tommy notes that there’s no one-size-fits-all financial aid strategy for restaurants, and most businesses received government aid from multiple sources. However, double-dipping on employee wages to claim an ERC credit is not allowed.

Employers cannot use the same employee wages to quality for:

- Families First Coronavirus Response Act (FFCRA)

- Work Opportunity Tax Credit (WOTC)

- Other tax credits

- PPP Loan forgiveness

A very important note for eligibility is that ETC credits only cover full-time employees, which excludes team members working less than 30 hrs/week.

Tommy gives a great example for operators to relate to — he worked with restaurants employing 300-400 staff members, but those companies were not eligible for the ERC because a majority of employees were not full-time. Restaurants are more included to hire part-time or seasonal employees, so operators should take caution when calculating their ETC eligibility.

Calculating the ERC for 2020

Step 1: Calculate the number of 2019 full-time employees employed by your business

- If Step 1 ≤ 100: All employees’ wages are eligible

- If Step 1 > 100: Wages for employees ‘not providing services’ are eligible.

Step 2:

Calculate your credit based on the qualified wages up to $5,000 per employee (50% of up to $10,000 per employee).

The credit is calculated on an annual basis, so if an employee was furloughed and came back, their wages are eligible as long as they earned $10,000.

Calculating the ERC for 2021

Step 1: Calculate the number of 2019 full-time employees employed by your business

- If Step 1 ≤ 500 = all employees’ wages are eligible

- If Step 1 > 500 = wages for employees ‘not providing services’ are eligible.

Step 2: Calculate your credit based on the qualified wages up to $7,000 per employee per quarter (70% of up to $10,000 per employee).

The credit is calculated on a quarterly basis which makes 2021 credit eligibility even easier for restaurants.

Claiming the Employee Retention Credit

Claiming the ERC is a fairly straightforward process that restaurant operators can complete themselves or with a tax advisor.

Retroactively claiming

File a Form 941-X, adjusted employer’s quarterly federal tax return.

Because the 941-X form was already filled out, this required amendment to that form. The panelists recommend using an advisor here, especially if your company conducts payroll internally.

Current claim

File a Form 941, Employer’s Quarterly Federal Tax Return.

You can let your payroll company know that you’re eligible and they can begin calculating this for you.

If you have a PPP second-drawn loan, Tommy recommends waiting until the money is received and then amending the form. This presents any errors or reductions if your received PPP funding is not the original amount anticipated.

Claiming in advance

File a Form 7200, Advance Payment of Employer Credits Due to COVID-19.

For access to the recording, click here.

For more information, visit: https://www.aprio.com/covid-19/