Shifting Liabilities Unsettle Franchise Industry

- By Harri Insider Team | July 30, 2019

In the already murky waters of franchisee/franchisor relationships, recent developments in Joint Employment laws may further complicate which entity is held responsible in cases of unfair or illegal employment practices.

Joint Employment Definition Continues to Shift

Who is liable when there’s litigation over unfair labor practices at the franchise level — the mom-and-pop owners or the corporate office? That’s yet to be decided after several twists and turns in policy, lobbying and lawsuits.

Under an Obama-era rule, the definition of “joint employment” meant that when fast food workers believed they were being treated unfairly as they protested minimum wage laws, they were able to sue the corporate office of McDonald’s instead of just the individual franchisee.

Yet a new rule currently under consideration by the U.S. Department of Labor (DOL) seeks to narrow what qualifies as “joint employment.” Specifically, it dictates that the company in question must exercise the power to hire and fire employees, to supervise them and control their schedules, set their pay, and keep up their employment records. If franchisors have such direct control over employee practices, they will still be held liable for labor suits at the franchise level under the proposed rule.

Meanwhile the attorneys general of 18 states have written the DOL asking for a broader definition of “joint employment,” citing that a franchisor should qualify if they have the ability to exercise hiring, firing, discipline, and supervision, regardless of whether or not they actually do.

Organized labor also supports the broader definition of “joint employment,” arguing that the new rule as written gives large corporations a wide space to evade legal liability for violating worker rights. On the flip side, the International Franchise Association said that the franchise industry spent $33.3 billion on litigation under the previous rule that included a broad definition of “joint employment.”

The DOL has yet to issue a final rule of what constitutes “joint employment” after the public comment period ended recently on June 25th.

Franchisors Seek to Distance Themselves

The issue of who qualifies as a joint employer and is thereby responsible and liable for workplace infractions at the franchise level has impacted another aspect of the industry: workplace eligibility. For instance, the Dunkin’ brand chose to terminate agreements and sue nine franchise locations in Pennsylvania and Delaware after alleging that the franchises were not in compliance with federal employment law.

According to the lawsuit first reported by Restaurant Business, Dunkin’ found that the operators did not properly verify employees’ eligibility to work in the U.S., citing lack of I-9 forms and that the franchisees had not used E-Verify, an online system that ensures workers have the proper identification, as required in the franchise contract.

In light of shifting definitions of “joint employment” and the associated liability, Dunkin’ policed its own franchises before it could possibly be held responsible for practices at the franchise-level. Meanwhile the terminated franchises have counter-sued the brand, alleging that they were not given the opportunity to correct the workplace eligibility violations.

With neither case settled, the relationship between brand and franchisee stays turbulent, threatening the long term health of the business. After all, the Dunkin’ business model is 100% based on franchises with over half of its revenue generated from franchises, according to its most recent annual report.

How Franchises Can Better Approach Workforce Eligibility Verification

At this point, the definition of “joint employment” could stay broad in favor of franchisees or be finalized under law as narrower in protection of corporations. Either way, franchisors can ensure that they are protected by standardizing how franchisees make sure employees are legal to work in the U.S.

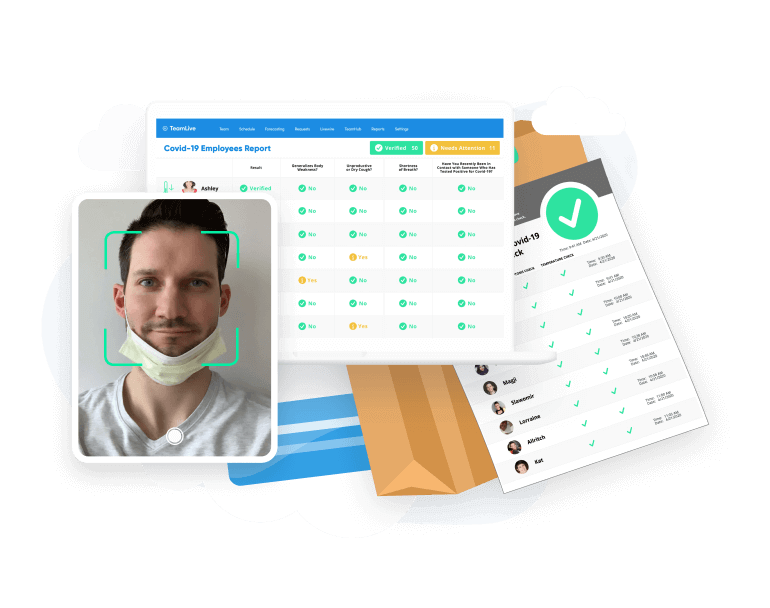

Harri, a workforce management platform built for hospitality, offers three fool-proof ways to make sure franchises’ hiring practices stay in compliance with federal law. For one, all required state and federal documents such as I-9 forms are completed in Harri’s online system where they are e-signed and stored. The system also offers seamless integration with E-Verify, in which I-9 forms and other employment eligibility verification documents are instantly checked against U.S. Department of Homeland Security and Social Security Administration records to confirm that individuals are authorized to work in the States. Finally, Harri’s online onboarding platform is also directly integrated with Employment Screening Services (ESS) and Checkr background check companies.

See how Harri can streamline and standardized best practices for workforce eligibility verification in your operation by requesting a demo today.