Essential Updates on Labor Regulations: 2024 Compliance Advisory

- By Harri Insider Team | February 9, 2024

Essential Updates on Labor Regulations

Revised Joint Employer Standards

Key Changes Effective February 26, 2024: The National Labor Relations Board (NLRB) has postponed the implementation of the new joint-employer standard to February 26, 2024. Originally scheduled for December 26, 2023, this shift allows for resolution of legal challenges. Under the new rule, entities can be considered joint employers if they share or codetermine key employment terms such as wages, schedules, and working conditions. It’s a significant departure from the 2020 standard, grounded in common-law agency principles.

For the hospitality industry, especially fast food restaurants, this rule change holds significant implications. It means that fast food chains may be more frequently classified as joint employers with their franchisees, making them potentially responsible for employment decisions made at individual franchise locations. This could lead to increased oversight on how these restaurants manage their staffing, pay, and working conditions, requiring a more unified approach to employee management across the entire brand.

Transforming Overtime Regulations

A Step Forward from August 30th, 2023: The U.S. Department of Labor’s proposed rulemaking is a game changer, particularly for salaried workers earning under $55,068 annually. It redefines who qualifies for overtime, introduces automatic updates to salary thresholds every three years, and aligns U.S. territories with federal overtime protections.

These proposals closed for public comment in November 2023, heralding significant shifts in overtime and minimum wage exemptions. Watch for the final rule, expected in 2024, which will broaden overtime protections and update compensation thresholds.

DOL's Final Rule Comes into Effect

New Guidelines Effective March 11, 2024: The U.S. Department of Labor (DOL) announced a pivotal update on January 10, 2024, with its final rule revising independent contractor classification under the Fair Labor Standards Act (FLSA). The final rule introduces a multifactorial ‘economic reality’ test to differentiate employees from independent contractors. It examines six key factors, treating each as part of a holistic assessment rather than in isolation. This includes analyzing the nature of the work, the degree of control over the work, and the worker’s investment in their own business.

This ruling is particularly crucial for the hospitality sector, where independent contractors are commonly engaged. Businesses need to meticulously review their workforce arrangements to ensure they are correctly classifying workers according to the new guidelines.

Local Minimum Wage Updates

Boulder County: A Progressive Approach

Effective January 1, 2024: In unincorporated Boulder County, the new Local Minimum Wage Ordinance went into effect on January 1, 2024, and is set to increase annually until it reaches $25 per hour by 2030. This mandate is a commitment to fair compensation for all employees in the region.

California: Raising the Bar in the Fast Food Industry

From April 1, 2024: With the passing of AB1228, fast food workers in California will see an increase in minimum wage to $20 per hour. Additionally, an annually adjusted wage based on the Consumer Price Index will start from January 1, 2025, with the power to increase wages expiring at the end of 2029.

New York: A Big Change

Beginning January 1, 2024: Governor Hochul has signed Senate Bill S2004 which increases the minimum wage in New York in annual increments. The increases are no longer based on the employer’s size, and New York City, Long Island County, and Westchester County are now grouped together. As a result, the minimum salary thresholds for “executive” and “administrative minimum wage and overtime exemptions have also increased. Separately, effective March 13, 2024, New York will change the salary threshold for wage-payment protections under New York Labor Law for certain employees in a bona fide executive, administrative, or professional capacity from $900 to $1,300 per week.

For more information on minimum wage adjustments in other areas, we recommend you check out our comprehensive “2024 Minimum Wage Guide“.

Enhancing Salary Transparency

Colorado’s Commitment to Equality

A New Era from January 1, 2024: Under Colorado’s Equal Pay for Equal Work Act, every job posting must be accessible to all Colorado employees, regardless of the job’s location. Employers are now obliged to include not just the salary range in their job postings but also a detailed description of all compensation forms. This includes bonuses, commissions, and other financial incentives. Additionally, they must provide a thorough summary of benefits, such as healthcare and retirement plans.

Hawaii Joins the Movement

Starting January 1, 2024: Hawaii’s SB1057 requires that all job listings openly disclose an hourly rate or salary range that reflects the expected compensation. It’s important to note that this requirement does not apply to internal transfers, promotions, public employee positions governed by collective bargaining, or employers with fewer than fifty employees.

Anticipating Changes in Massachusetts & Washington, DC

Massachusetts Embraces Transparency and Diversity

In an effort to promote transparency and diversity, soon, employers may be required to include salary ranges in their job postings, a move that promises to demystify compensation for prospective employees. Additionally, a significant shift is underway with potential legislation mandating larger private employers (those with over 100 employees) to submit annual aggregated Equal Employment Opportunity (EEO) data. This initiative is designed to bolster diversity and inclusion monitoring, paving the way for a more equitable workplace environment.

Washington, DC Sets New Standards in Wage Transparency

Concurrently, Washington, DC is finalizing the groundbreaking Wage Transparency Omnibus Amendment Act of 2023. Signed into law by the Mayor on January 12, 2024, and set to take effect on June 30, 2024, this act requires employers to disclose minimum and maximum salary estimates in their job listings. Moreover, it mandates the disclosure of benefit schedules to applicants.

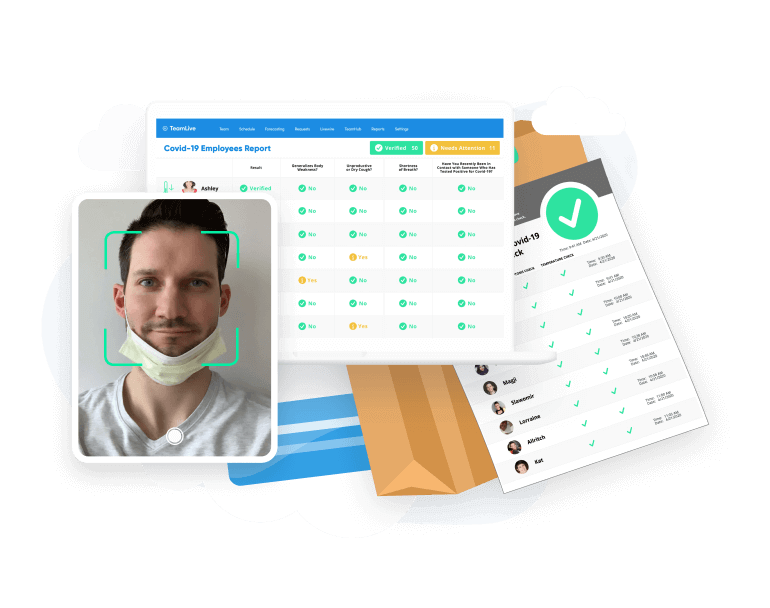

Harri: Your Partner in Compliance

As employment regulations continue to evolve, Harri stands by your side, ready to assist in managing these changes. Recognized for our expertise in employer technology solutions, we focus on equipping clients with the necessary tools and insights to stay compliant. Harri enables you to create transparent and equitable workplaces, staying informed and ahead of regulatory shifts. Choose Harri as your partner in compliance, ensuring your business remains competitive and prepared for future challenges and opportunities.